Innovative analytics for risk selection and capital allocation

Wildfires cost insurers more than $13 billion dollars in 2020.

The unpredictable nature of fire and the complex human and environmental relationships that contribute to fire risk makes it a challenging peril to insure against. Willow’s innovative suite of machine learning models bring clarity to insurers and reinsurers operating in the western United States by providing tools that improve risk selection, pricing, and capital allocation.

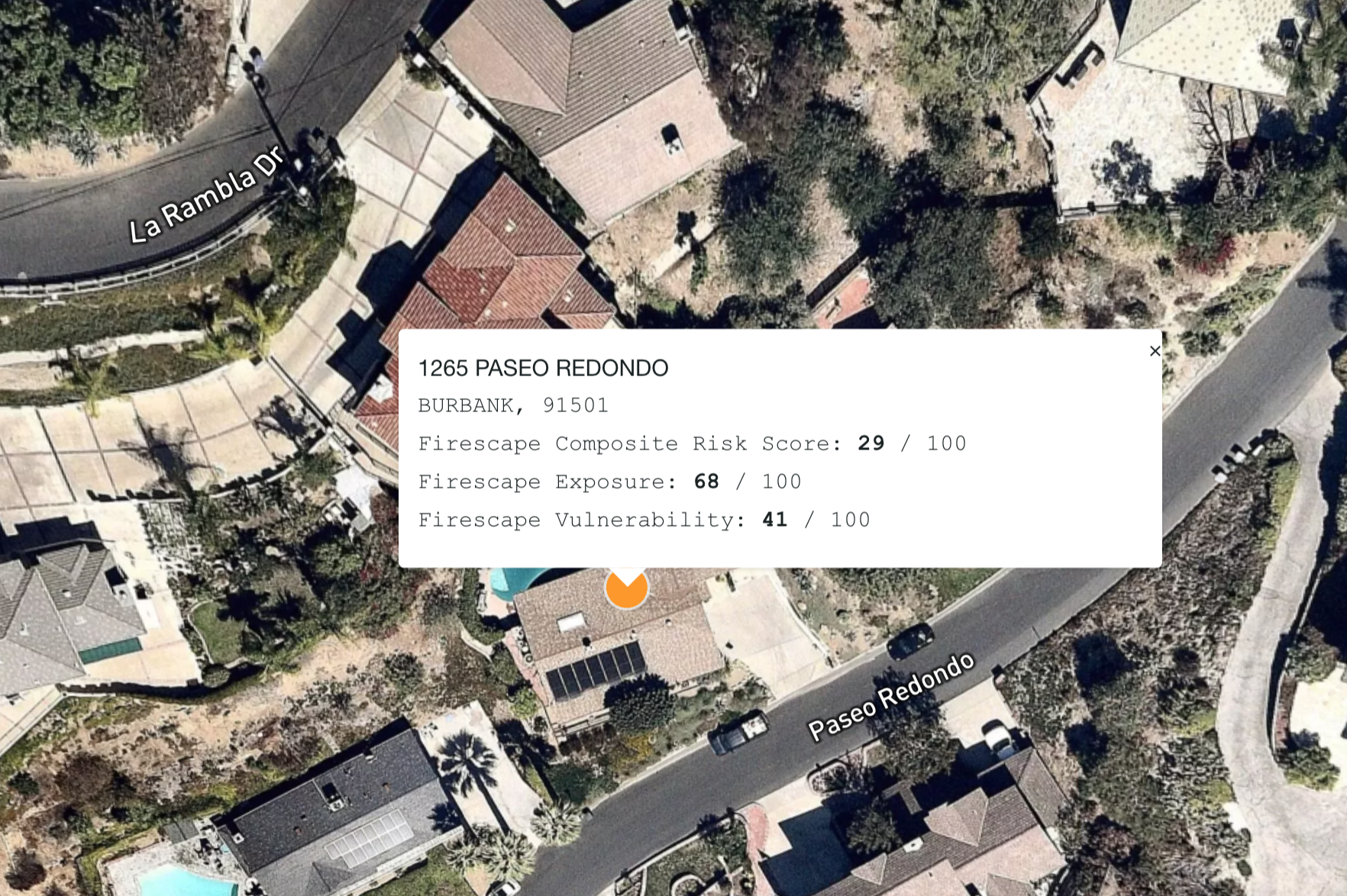

The Willow Analyst platform combines monte-carlo simulation with statistical analysis and geospatial visualization to provide deep insights into risk at the property and portfolio levels. Drawing on millions of simulated wildfires, vast amounts of remote sensing data, and proprietary risk modeling algorithms, Willow produces detailed, accurate risk scores at the property level, key portfolio-level metrics, and advanced visualization capabilities – all seamlessly integrated within one platform.

Decide on Data, Not Your Gut

Forward-Looking Risk Analysis

Climate change is increasing the wildfire threat across the globe. With fire activity forecast to increase by over 50% by the end of the century, the last decade of heightened wildfire losses is just the tip of the iceberg. Willow’s models allow you to adjust risk selection and pricing accounting for a hotter, drier, more fire-prone world. Using leading scientific models of climate and vegetation change, Willow Analyst allows insurers to price for changes in a property’s annualized risk and derive forecasts of probable maximum loss (PML) and annual average loss (AAL) out to 2050 under one of several climate scenarios.

Deep Insights

Wildfire risk is dynamic and understanding the fiscal impact of catastrophic loss events is challenging for even small portfolios. The challenge becomes even more difficult when deciding how to price risk in portfolios of thousands or tens of thousands of homes. Willow Analyst provides top-line statistical measures, paired with detailed per-property, geospatial analyses of wildfire risk, allowing you to explore correlated risk factors across scales.

Advanced Models

De-facto standard risk analysis tools in use across the insurance industry lack the resolution and analytical capabilities to effectively select and price risk in fire-prone regions. Willow’s state-of-the-art deep learning models produce reliable, accurate assessments of fire risk at the structure-level using aerial imagery, satellite-derived ecological and environmental data, and ground-collected defensible space inspection data.